Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an administrative assistant who has a joint income of $89,440 per year and spends some of her money this week on blueberries.

Occupation: Administrative Assistant

Industry: Manufacturing

Age: 25

Location: Grand Rapids, MI

Salary: $47,840 (I also expect to get a $5,000 bonus).

My Husband’s Salary: $41,600

Net Worth: -$27,459 (personal checking: $100, joint checking: $631.88, HYSA: $9,368.58, 401(k)s: $8,500, Roth IRAs: $3,500, travel savings: $775.25, school savings account: $364.06, value of car: $8,000, minus debt. My husband and I maintain our own separate checking accounts for our own spending and we will often take turns paying for food etc. out of those if we are together. We share a joint checking account for all of our shared expenses including rent, car insurance, groceries etc. We also share a credit card and consider our finances shared).

Debt: $58,699 (my student debt: $3,560, my husband’s student debt: $53,000, shared credit card debt: $939.77, my husband’s credit card debt: $1,200).

My Paycheck Amount (weekly): $517

My Husband’s Paycheck Amount (biweekly): $1,200

Pronouns: She/her

Monthly Expenses

Rent: $400 rent (my half, $800 total).

Electricity: $30-$50 (my husband pays).

Husband’s Student Loans: $450 (when they resume).

My Student Loans: $75 (when they resume).

Health/Dental Insurance: $480

Car Insurance: $235

Hulu: $14.99

Spotify: $12.99

Online Pilates Membership: $30

Travel Savings: $100 (my husband contributes the same).

HYSA: $200 (husband contributes the same).

School Savings: $200

Compost: $14

Cell Phone: $40

Annual Expenses

Chase Sapphire Reserve: $625 for two cards.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There wasn’t an expectation for college specifically but my parents definitely wanted my sisters and me to do something beyond high school to continue our learning. I never had the thought of not going to college so I didn’t really consider any other options. My first year, I had to take out about $4,500 in loans for room and board. I had a very large merit-based scholarship and I got a lot of grants because we were low income. For my sophomore and junior years, I was an RA so I received free room and board. My senior year, I studied abroad my first semester so I had to take out an additional $2,500 to cover the remaining costs. My second semester of senior year, I lived off campus with my family and my scholarships covered my tuition expenses.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We didn’t really have any conversations. My dad handled most of the family finances for taxes and such, and he would never talk about it. My mom earned most of our household income working from home because my dad was always moving jobs. She was raised poor so she has an extreme scarcity mindset. I can’t think of any real money lessons I was taught beyond being scared of not having money and saving as much as possible, which never seemed like something my parents could do once they had kids. It’s taken a lot of time and work to undo that thinking and feel comfortable managing my finances.

What was your first job and why did you get it?

My first job was babysitting at the age of 12 so that I could have spending money. Most of it went to my savings account, which my mom set up for me. My first actual job was working at a local campground. I got that job to save for a car and to have money for things that weren’t necessities.

Did you worry about money growing up?

Yes, I was constantly worried. My parents always made it seem like we had no money. I think I was more worried than I should have been because we had a relatively nice house for our area, always had food and were able to buy extra small things. We would occasionally go on family road trips but we would typically only go farther from home if my grandparents paid. My grandparents were also the ones who usually bought us new school clothing and who would get us the nicer things we wanted for Christmas. My parents divorced when I was in high school and I had to take over paying for school activity fees. We also only had health insurance intermittently when I was growing up because both of my parents worked for themselves and my dad wouldn’t hold jobs long enough to have insurance at a full-time position.

Do you worry about money now?

Not much. I do feel a general sense of doom about finances in the future (the usual: buying a home, having kids etc.) but overall I feel stable and my husband and I are able to easily afford our necessities. I am more worried about the next two years or so because I recently decided to pursue my master’s degree (for more earning potential) so spending and saving are starting to look very different.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At 22 I became financially responsible for myself. I was mostly responsible for myself throughout college but my mom still paid for my phone and my car insurance. My grandparents also gave me $150 a month in college but I usually put that into savings.

Do you or have you ever received passive or inherited income? If yes, please explain.

As stated above, my grandparents gave me $150 every month that I was in college (excluding summers). I received $2,500 from my great grandma, which I used part of to buy my first car. My maternal grandparents gave me another $1,500 for my first car, of which I paid them $500 back. My maternal grandparents also gave me $2,500 a few years ago as an early inheritance from them. I used most of mine to pay for my study abroad trip. My paternal grandparents gave my husband and me $1,000 when we got married.

Day One

9:30 a.m. — I wake up and spend some time lying in bed, checking social media and doing the NYT Wordle, mini crossword and Vertex, which I do every morning. My cat hangs out with me. My husband, P., and I usually have slow Sunday mornings in bed together but he couldn’t sleep and is already up and working on some studying for IT certifications. He’s been having trouble sleeping because he got some bad news about his dad’s health last week. It’s weighing on both of us but especially him.

10:30 a.m. — I finally get out of bed because I’m hungry and need something to eat. I have some leftover cooked veggies. I also eat a scone I bought at a bakery yesterday and have a cup of earl grey. P. and I hang out on the couch for a while. He’s playing video games and I’m just scrolling social media and reading some NYT (I have a yearlong subscription gifted to me by my sister for Christmas).

12:45 p.m. — My best friend texts me that she and her boyfriend are at a food hall close by so P. and I head over and join them.

2:30 p.m. — We go into the food hall to find some late lunch. P. and I decide to get Thai food and I pay ($23.88). We enjoy it upstairs in the seating area with the others and it is SO good to catch up. We don’t get to see each other nearly as much as I would like to because we live a few hours apart. P. wants a smoothie so I treat him to one and get myself a lemonade ($14). We also pick up some sushi-grade salmon for poke bowls for dinner this week and some shrimp from a fishmonger because they have the best, freshest fish in the city ($44 from our joint account, $22 my half). $59.88

7 p.m. — We have a later dinner. P. is gaming with his friends for a while so we just do a charcuterie board since neither of us wants to cook. While I’m eating, I finally remember to buy my brother-in-law a birthday present, which I’ve been trying to remember to do for weeks. We are celebrating his birthday this upcoming weekend. I place an order for four different hot sauces. This comes out of our joint account ($58 total, $29 my half). $29

9 p.m. — My husband and I have been working our way through a book together (The Assassin’s Blade). We like reading together as a way to spend time doing something a little different. We read some of that and then I brush my teeth and get ready for bed. I read for another hour (White Houses by Amy Bloom) and then head to bed.

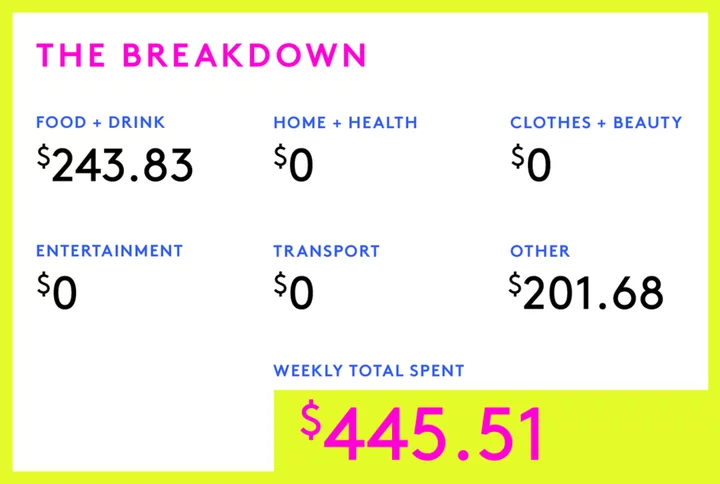

Daily Total: $88.88

Day Two

6:45 a.m. — I wake up and the cat immediately walks all over me (it’s our morning routine). I spend about half an hour scrolling and doing my NYT activities, then get up and feed the cat. I brush my teeth, brush and braid my hair, put in my contacts and get dressed. I pack all my lunch foods and then make myself a smoothie (I make a smoothie every morning during the work week). It’s usually some combo of oat milk, whatever fruit we have on hand, protein powder and Greek yogurt or peanut butter. Sometimes I get wild and add cocoa powder too. I pack everything into my backpack and get my bike from the basement to head to work.

8 a.m. — I get to work, change out of my bike clothes and clock in. I catch up with my boss about our weekends. I spend the next few hours doing invoices. No one said it was an exciting job. I see that the Twilight audiobook I had on hold is available and I get ridiculously excited because I know what I get to listen to all day! It’s so bad. So, so bad. But I can’t resist, it’s so good.

11 a.m. — I am finished with all my invoices for this morning and don’t really have anything else to start on before lunch so I finish up my grad school application. I get my application and my resume submitted and will have a few more documents to submit when I get home that are on my personal computer. I feel a crazy rush of adrenaline, even though it’s not fully submitted yet. It feels like a huge step! I also pay the $60 application fee. $60

12:30 p.m. — I eat my lunch (assorted charcuterie from last night) and then get to work on a report I have to do every day. It usually takes me about an hour and a half and is very monotonous so I always have either a podcast or audiobook going. Today it is, of course, Twilight. I’ve already cringed so much in the first two hours of listening. It’s fantastic.

3 p.m. — I’m sitting at my desk doing nothing and my boss comes by. She asks me if I’m bored and when I say yes, she tells me to go home. If my boss commands it, I do it. I bike home an hour early and greet the cat, who is waiting for me by the door. P. was supposed to be gone until about 7:30 p.m. at a conference but he gets home early. He tells me he was feeling really tired and overwhelmed with everything with his dad so he couldn’t stay for the whole thing. We talk for a while to catch up and check in with how we are both doing.

5:30 p.m. — I do my Pilates workout and then get started on dinner. We are having homemade poke bowls with the fresh salmon we got yesterday. We have them with blistered garlic green beans, sushi rice and cucumber. It’s one of my favorite meals and SO GOOD. Then we sit down to watch season one episode one of The Witcher. We’ve already watched seasons one and two but we are doing a rewatch before we start the new season.

8 p.m. — P. and I read some more of our book together, then I brush my teeth and take a body shower before bed. I start reading The Vampire Lestat. I read for about an hour and then lights out at 10.

Daily Total: $60

Day Three

6:45 a.m. — Normal routine of NYT and feeding the cat. I get ready and dressed, same routine as yesterday. I prep breakfast (smoothie) and lunch (charcuterie) and drive to work today because I have a dentist appointment this afternoon.

8 a.m. — I drink my smoothie and get situated at my desk before going to catch up with my coworkers. I then get down to doing invoices.

12 p.m. — I finish up my report and then eat my lunch. By the time I’m finished, I only have about 15 minutes until I have to leave for my dentist appointment so I don’t bother starting anything else.

2:20 p.m. — I’m finally finished with my dentist appointment. I make a quick 10-minute run into the small grocery store on the way home to grab a bell pepper, sweet corn, buttermilk, yogurt and some herbs. $23.78

2:30 p.m. — I finish up my work day from home. P. is already home so we chat while I work. He gets started on a recipe for cowboy caviar for dinner tomorrow so that we can eat quickly before we head out on date night. I notice later that the cat has diarrhea and I get worried. I call our vet and they recommend bringing in a stool sample so P. takes one over since I am still working. He pays out of our joint account for the test while he is there. I finish up work and then do my Pilates. $25

6:30 p.m. — I make a dinner of sandwiches with mozzarella, prosciutto, tomatoes, pesto and lots of garlic. They are SO GOOD and I make some zucchini to go along with them. They are very tasty and we watch the next episode of The Witcher while we eat. I take a shower, then we do our same nighttime routines and I head to bed around 10.

Daily Total: $48.78

Day Four

6:45 a.m. — Up and at ’em again. I do my same morning routine as the other days except I decide to pick up a bagel before work. I drive to work again today because the air quality is bad and we have a chance of thunderstorms later this afternoon. I eat my delicious maple and cinnamon bagel with plain cream cheese as I settle into work. $4.34

10 a.m. — I’m really struggling to work. My sister and I are having a huge argument over text. I would 100% prefer to do it in person but she’s been a bit distant and we’ve hardly seen each other in the last few weeks. I’m so mad and can’t focus. My boss tells me if I need to take the rest of the day off for mental health I can, but I’m going to wait and see how I feel (did I mention my boss is the best?).

2 p.m. — I decide to power through to the end of the day because I know that if I don’t, I will be more stressed about the work I will have to catch up on tomorrow. I get my report done and then clean up some piles of invoices and other emails I have.

4:30 p.m. — When I get home, I tell P. about the fight with my sister. He makes some good points about something I said that wasn’t great but overall he says that while I do get fiery, I wasn’t out of line, which is what I was worried about. I cry about it a bit from frustration and then get to my Pilates. I do a very short session, take a quick body shower and then rush to eat dinner because we are going to see a symphony play The Goonies in concert! It’s one of P.’s favorite movies and we are both excited.

7 p.m. — We find parking in the parking garage right across the street from the venue and P. pays the $12. We rush inside and go through the scanners then jump in line for some M&Ms. P. pays the $10 for that and a water for me. We watch the movie while the symphony plays and it is incredible.

9:15 p.m. — We get home and get ready for bed. P. goes to sleep and I read for about an hour before lights out.

Daily Total: $4.34

Day Five

6:45 a.m. — Same exact morning routine. I drive to work again today.

12 p.m. — Today is a slow day. Our industry really has ebbs and flows and right now we are in an ebb. I eat lunch (leftover cowboy caviar, some pretzels and a peach) and then get to work on the report.

4 p.m. — I head home with my laptop in tow so that I can work from home tomorrow. I love working from home occasionally, it feels like a mini vacation. I do my Pilates workout when I get home. I talk to P. for some ideas about what to do to solve things with my sister because we didn’t get to a resolution yesterday. He suggests trying to see her in person so I invite her to dinner tomorrow night.

6:30 p.m. — I make hamburgers for dinner with zucchini on the side. We watch another episode of The Witcher while we eat. After, I take a body shower and then we read some more of our book before falling asleep.

Daily Total: $0

Day Six

7:30 a.m. — I wake up later since I am WFH today.

9 a.m. — I make a smoothie then get to work. I take a break to browse Chewy and order some more cat food. Our cat is on a prescription diet and it’s expensive. While I’m at it, I throw in two toys and some silver vine twigs. $87.68

11:45 a.m. — There’s a lull in work right now so I do some Pilates. I love being able to get it done midday when I work from home. After, I eat some more cowboy caviar for lunch and then cook some corn on the cob for a corn salad I’m making later.

4 p.m. — I sign off for the week and then jump in the shower. I do a very thorough shave because we are going to a lake for a cookout tomorrow and I haven’t done a full shave in months. I tend to do piecewise as the situation demands it. My sister texts me at 4:45 that she has arrived at our place to talk before dinner. We talk a bit and things seem back to normal. It’s a huge relief because we are extremely close and it was hard not being able to talk to her normally, even if it was for just a day.

5:30 p.m. — We pick my mom up from her house and go get tacos and horchata. My mom pays because we order a big platter and I venmo her for my portion. My sister and I end up staying at my mom’s for another hour after we drive her back, just chatting and spending time with our mom. $15

9:30 p.m. — P. is spending the night at his dad’s so that he can see him and spend more time with him. We chat for a bit when I get home so that he can update me on his dad’s tests he had done this week. It’s not super optimistic. It’s just me and the cat holding down the fort tonight. I spend a lot of time scrolling and I had every intention to read but it’s 10:45 before I know it. P. sends me a sweet goodnight text and then I head to bed.

Daily Total: $102.68

Day Seven

7:30 a.m. — I wake up a bit earlier than usual for a Saturday. I want to make sure I have time to get to the farmers’ market and finish making the salad I’m taking today for a birthday cookout for my brother-in-law. I get up and get ready.

8:30 a.m. — I get to the farmers’ market. I hit up my favorite farmers for a variety of fruits and veggies. I get tomatoes, summer squash, dill, cilantro, peaches, nectarines, five pints of blueberries, a dozen eggs, cucumbers and spinach. Going to the farmers’ market is one of my favorite Saturday morning activities! This goes on our joint card ($72.27 total, $36.13 my half). $36.13

9 a.m. — I head to the specialty grocery store and bakery that’s very close to the farmers’ market. I only get a few things at the grocery store including some shallots, sweet corn, spinach dip and a pint of Ben & Jerry’s. I walk next door to the bakery and get a loaf of day-old bread, two blueberry muffins for P., a mini asparagus quiche for my breakfast this morning and a chocolate chip scone to eat tomorrow. ($42.08 on the joint card, $21.04 my half). $21.04

10 a.m. — When I get home, I quickly eat and then make corn salad. I also place a scheduled Instacart order for the few items I need that I couldn’t get at the farmers’ market or the grocery store this morning. I schedule it for this evening after we should be home from the cookout. P. gets home and then we head out to get my sister and mom.

11 a.m. — We get my sister and mom and then head to the lake and set up our cookout spot. We get a beautiful spot under shady trees, right by the water. We swim for a bit and then my older sister starts prepping lunch. We have grilled hamburgers, corn salad, pasta salad, kale salad, sliced fruit, chips and Rice Krispie treats for dessert. My brother-in-law opens all of his presents and he’s super excited about the hot sauces. We swim for a while after that and enjoy the beautiful day and the beautiful water.

5 p.m. — We pack up around 4 to head home and then drop my mom off. P. decides he wants to smoke when we get home so my sister runs to her apartment to grab all her smoking equipment and then comes back over. I take an edible in the meantime because I don’t love smoking and then our Instacart order is delivered. We get bananas, oat milk, pita chips, lunch meat, provolone, olive oil, parmesan, a watermelon and a few other items. There is no delivery fee since we have free Instacart+ with our credit card ($98.28 total, $49.14 my half). $49.14

6 p.m. — My sister gets back from her apartment and gets to rolling a nice joint. I join her and P. on the patio and take a few hits to kickstart my edible but leave most of it up to them. Once we finish it, we head back inside to play some video games.

7:30 p.m. — We put on a movie and decide to order Chick-fil-A. We also get free Dashpass with our Chase card and I have a $5 credit so the total is only $34.52 for our whole order of 30 nuggets, large fries and drink. We quickly demolish it and then I still feel hungry so I have more corn salad, some pretzels and ice cream. My sister leaves at some point during the movie and I start playing solitaire on my phone and get completely absorbed. After we finish the movie, I scroll for a while, then fall asleep for a delightfully sound night of sleep. $34.52

Daily Total: $140.83

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.