More Chinese travelers are delaying outbound plans amid economic uncertainty, according to a new survey, potentially rough news for countries depending on one of the world’s biggest source of tourists.

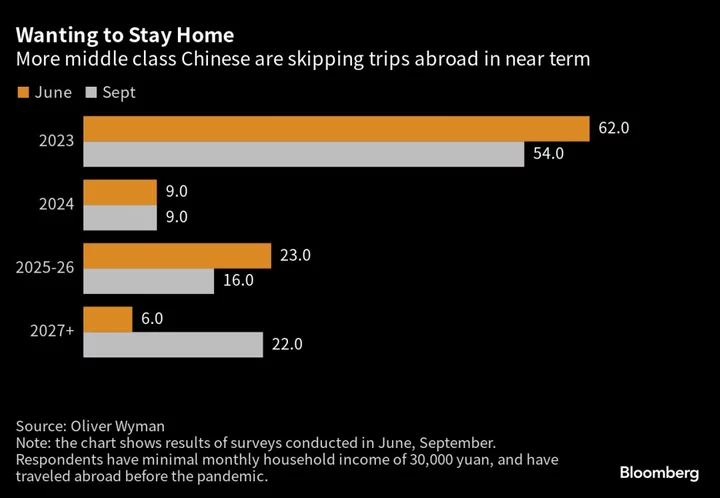

A September survey by consultancy Oliver Wyman found that 54% of respondents — all experienced travelers who had been abroad before the pandemic shut Chinese borders — said they planned to travel in 2023, down from 62% polled in June.

Some 22% said they didn’t have plans to venture overseas for the next three years, up from just 6% in June.

Respondents needed to meet a minimal monthly household income of 30,000 yuan ($4,105), representing the country’s middle class — a key driver being counted on to help boost China’s post-Covid consumption recovery. While spending on experiential services like travel and eating out has been resilient this year, questions have risen about whether that’s sustainable.

Read more: China Gen Z Tries to Leisure-Shop Way Out of Jobless Blues

“While Chinese travelers are returning, it’s taking longer than we expected when the border reopened,” said Imke Wouters, an Oliver Wyman partner who led the research.

The survey also showed 32% of respondents saying their willingness to travel abroad had decreased amid the current economic downturn and political situation, while only 19% said they were more inclined to take international trips.

Enthusiasm for domestic travel remained strong, meanwhile, with 35% saying they were more disposed to journey within China, and just 14% decreasing.

China’s economy picked up steam in August as a summer travel boom and stimulus push boosted consumer spending and factory output, adding to nascent signs of stabilization. Still, the upcoming 8-day Golden Week holiday will be another test of whether Beijing’s recent efforts to bolster the economy are starting to bear fruit.

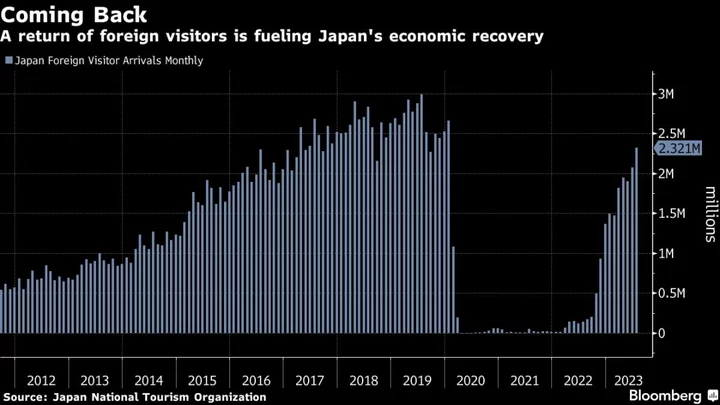

More than 21 million people are expected to fly during the holiday, starting from this Friday, sending airfares climbing. Domestic tourism spots — and short-haul Asian destinations such as Thailand, Japan and Korea — are among the top choices.

Read more: Millions to Take to Skies as China Gears Up for Long Golden Week

And it’s not just travel: the middle class’s worries about the economy may also be reflected in their luxury expenditures. Of the casual luxury shoppers polled by Oliver Wyman — those who spent less than 40,000 yuan this year — 16% expected to increase their luxury spending, while some 30% considered cutting back.

Big spenders — people who spent more than 40,000 yuan — remained more resilient and positive.