Dish remains on course to build the US’s first new nationwide wireless network in decades and will meet a June deadline to cover 70% of the country’s population with this greenfield 5G service, a company executive assured attendees of a telecom conference in Washington, D.C.

“We're going to get it done,” said Dave Mayo, EVP of network development at Dish Wireless, in a talk Wednesday afternoon at the industry trade group CTIA’s 5G Summit.

Dish, a subsidiary of the satellite-TV company Dish Network, acquired that mission and deadline as part of T-Mobile’s 2020 purchase of Sprint. Those two firms responded to early objections to the deal by pledging to divest Sprint’s Boost Mobile prepaid brand and sell wireless spectrum to Dish.

Dish then committed to combining those assets with spectrum purchased years earlier to build a new network and return a fourth nationwide service to the wireless landscape.

“We've built a standalone 5G network in record time,” Mayo said Wednesday. Dish met one commitment to the Federal Communications Commission by bringing service to 20% of the US population by last July, and now it has less than a month before its next major milestone.

“We have to have 70% of the country covered in some 28 days, and we'll meet that objective as well,” he said.

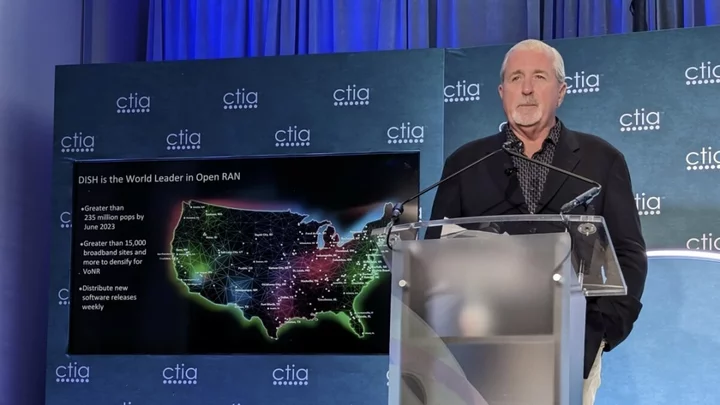

The agreement it struck with the FCC, as modified in September 2020, calls for it to cover “at least 70% of the population” in each “economic area,” an FCC geographic construct that can look a bit like an oversized Congressional district. Mayo said this buildout will bring Dish to 15,000-plus cell sites, covering more than 235 million people.

Dish began selling service under its new Boost Infinite brand in December, with unlimited 5G going for $25 a month to people with addresses in its coverage area. The service fills in gaps in coverage with leased service from AT&T and T-Mobile.

Mayo credited Dish’s Open RAN (Radio Access Network) architecture, in which open-standard interfaces let a carrier combine network gear from multiple vendors, and cloud-based network management platform with boosting that buildout.

“We can mix and match things in a way that you really can't with legacy networks,” he said. “There's absolutely no way we could have done what we did if we didn't put the core network in the cloud.”

The big three carriers have yet to show comparable interest in Open RAN, although the government-backed effort to help smaller carriers rip out Huawei and ZTE network gear is banking on Open RAN.

Mayo did note one downside of this open, multiple-vendor architecture: If something goes wrong, “we don't have that single neck to grab.”

He did not, however, discuss other obstacles for Dish in this quest.

Phone compatibility is a big one. While the selection of phones that work on Dish’s 5G network is no longer limited to a single Samsung model, it remains Android-only. On Dish’s first-quarter earnings call May 8, Chairman Charlie Ergen said iPhone support will come “within the next few months.”

Dish is also still recovering from a ransomware attack in February that knocked customer-service systems offline. Fortunately, it has yet to start marketing Boost Infinite on a nationwide level. Dish isn’t saying when that might happen, although sometime after that June deadline would make sense.

Dish faces another FCC-mandated deadline in June 2025, when it must cover 75% of the US population. In a bleak research note posted in April, MoffettNathanson said Dish’s mounting levels of debt would make it impossible for Dish to meet that deadline and would instead force it to start selling off some of its spectrum.

On that Q1 earnings call, Ergen answered a question from MoffettNathanson analyst Craig Moffett about possible spectrum sales by saying “Obviously, we have assets” and adding cryptically “I think there's more opportunity for us than people realize, let's put it that way.”

The FCC gave Dish an extra irritant Thursday when it voted unanimously to decline Dish’s request to free up 12.2-12.7GHz spectrum for mobile use and instead preserve that band for such satellite operators as SpaceX’s Starlink.

The FCC order does, however, open the door to fixed-wireless broadband on those frequencies. That’s a market that Dish has already expressed interest in joining after seeing what T-Mobile and Verizon have done with home 5G. As Mayo said Wednesday before the FCC vote, “I'm a big believer in fixed wireless.”