The emirates of Abu Dhabi and Ras Al Khaimah have emerged as frontrunners to introduce casinos before their neighbor Dubai, after the glitzier city-state put any immediate plans to allow gambling on the backburner, according to people familiar with the matter.

After the United Arab Emirates set up a framework for legalized gaming in September, Abu Dhabi is mapping out what it would look like to open a casino, with Yas Island — home to the Ferrari World and Warner Bros. theme parks, as well as the Yas Marina Formula One Circuit — and a plot near the city’s port among the sites being considered, some of the people said, asking not to be identified because the discussions are private.

In Ras Al Khaimah, a northern emirate about a 45-minute drive from Dubai, Las Vegas-based Wynn Resorts Ltd. has announced plans for a $3.9 billion integrated resort that’s due to open in 2027. In Dubai, meanwhile, senior government officials decided after months of discussions that gambling wasn’t a priority for the city because its tourism sector is already booming, some of the people said.

It’s not clear how long Dubai may hold off on any plans to introduce casinos and authorities could revisit the idea if circumstances change, the people said. In the meantime, officials are considering the possibility of introducing a poker series to the city, one of the people said.

Step Change

The introduction of casinos would be a step change for the UAE where Islamic, or Shariah law, is the main basis for legislation. Gambling is prohibited under Islam and is illegal in the country, where offenders can be fined or sentenced to two years in prison, or both.

Although the plans are fluid and could change, the UAE is considering granting each emirate one casino license, which would allow them to tap the lucrative casino market while keeping growth under control, another person said.

What Bloomberg Intelligence says:

The casino market of the UAE could surpass that of Singapore in terms of revenue, although visibility of profitability is low as the government hasn’t defined a tax structure. Benchmarking against Singapore, UAE’s gaming revenue could reach $6.6 billion and implied gaming outlay per tourist in UAE might fall below that in Singapore and Macau. This is despite the similar consumption power of tourists in UAE, if crowded ultra-luxury hotels in Dubai are an indication. For more, read here

Speaking on a call in August, Wynn Chief Executive Officer Craig Billings said the company expects to receive its gaming license for Ras Al Khaimah soon. Elsewhere, the rulers of each emirate will be able to decide if and when they want to issue a license, the people said.

Representatives from the media offices for Abu Dhabi and Ras Al Khaimah didn’t respond to requests for comment. Dubai’s Department of Economy and Tourism also didn’t respond to a request for comment, nor did the federal government’s media office.

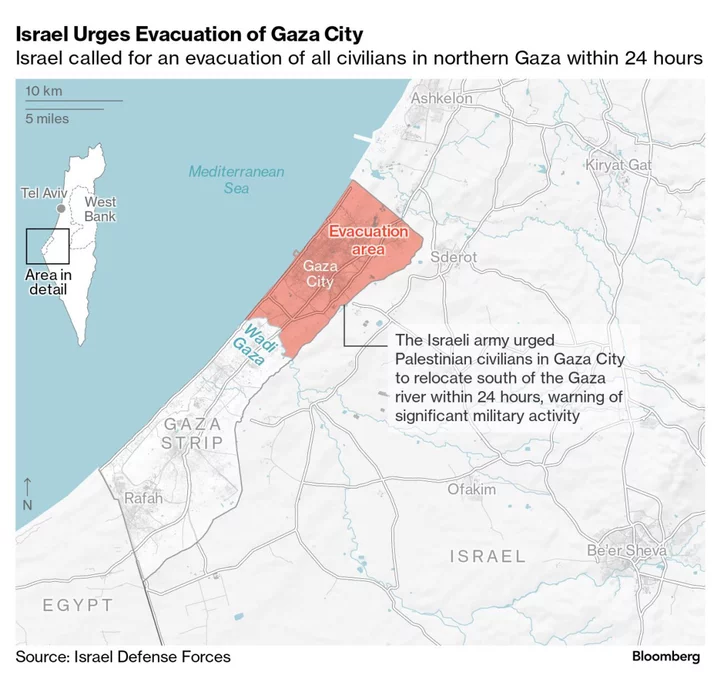

As each emirate works through their plans to introduce casinos, at least one industry executive said the Israel-Hamas war that erupted last month hasn’t changed their thinking.

“Irrespective of what’s happened in the past couple of days which is extremely tragic, we’re very progressive and excited by what could happen there,” MGM Resorts International CEO Bill Hornbuckle said at an industry trade show on Oct. 10. “We think there’ll be three or four [casinos] in the emirates. It’s up to each ruler to decide what they want to do and where they want to do it.”

Read more: UAE Sets Up Gaming Body In Potential Move Toward Casinos

Hornbuckle said he was still hopeful gaming would happen at a resort MGM is developing in Dubai with local developer Wasl, which is backed by Dubai’s ruler.

“We have a project which is now underway that we began to work on back in 2015 — it is on Plateau Island, it’s at the base of Jumeirah beach and the base of Burj Al Arab, they look at each other,” he said. “We’re positive. I’d love to be in Dubai with an operating company that has a casino in it, but one step and one day at a time.”

Even if Dubai decides not to have a casino of its own, it should still be able to benefit from some of the visitor traffic for casinos in Abu Dhabi or Ras Al Khaimah. The UAE is expected to pull in as much as $6.6 billion of gaming revenue annually and eventually surpass Singapore, according to Bloomberg Intelligence.

In September, the Accor hotel group said a Banyan Tree resort would replace Caesars Palace in Dubai on a development owned by Dubai Holding LLC. The split with one of the best-known names in the casino industry came just days after the UAE announced the formation of a gaming and lottery regulator chaired by former MGM CEO Jim Murren.

Caesars Entertainment Inc. opened the resort in 2018 with the goal of having a casino, CEO Thomas Reeg said on an earnings call in 2022.

--With assistance from Christopher Palmeri and Abeer Abu Omar.

Author: Shirley Zhao, Ben Bartenstein, Zainab Fattah and Lisa Fleisher