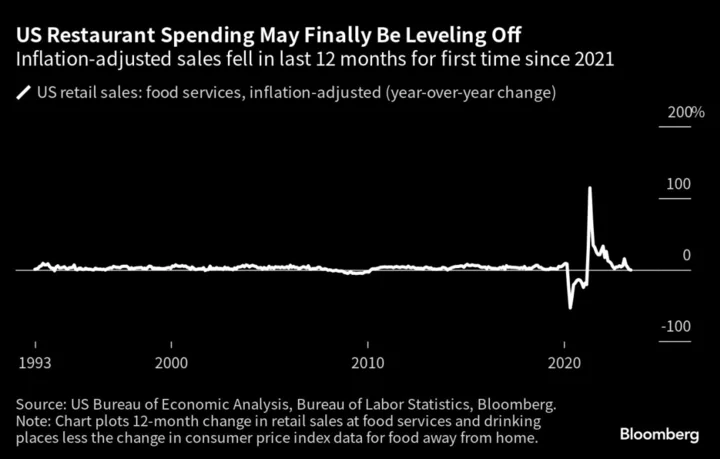

Consumer spending at restaurants in the US may finally be starting to level off following the pandemic-reopening boom, according to the latest data on retail sales and consumer prices.

Price increases for food away from home outpaced growth in retail sales at food services and drinking places in the 12 months through May, pushing growth in inflation-adjusted spending negative for the first time since early 2021, Bureau of Labor Statistics and Bureau of Economic Analysis figures published Tuesday and Thursday showed.

“It partly reflects some fatigue from the surge post-reopening, but at the same time it may also reflect a waning tailwind from excess savings,” said Brett Ryan, a senior US economist at Deutsche Bank AG.

Signs that consumers are pulling back from restaurant spending have emerged this year as chains such as Domino’s Pizza Inc. have reported that some households with less disposable income are moving away from ordering delivery and doing more cooking at home.

That may in part be due to a faster moderation in inflation for food at home than that for food away from home. Grocery prices were up 5.8% in the year through May, while restaurant prices were up 8.3% over the same period, according to consumer price index figures published Tuesday.

“A continuation of the steep moderation in grocery inflation in upcoming months could leave restaurants with less pricing power and/or cause some marginal shift in demand away from restaurants,” David Tarantino, an analyst at Robert W. Baird & Co., said Tuesday in a note to clients following the release of the CPI report.

Author: Matthew Boesler and Daniela Sirtori-Cortina