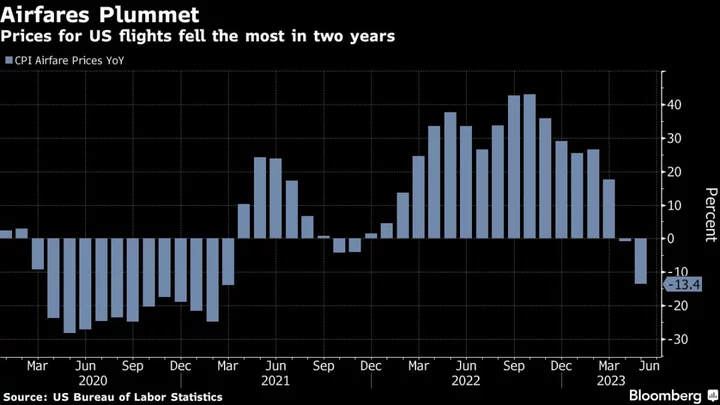

Ryanair Holdings Plc predicted strong demand in the peak summer season will drive a 10% increase in passenger numbers and “modest year-on-year” profit growth in the coming year as travelers return to flying after the pandemic.

The Dublin-based low-cost carrier reported profit after tax of €1.43 billion ($1.5 billion) for the fiscal year ended March 31, compared with a loss of €355 million a year earlier. Ryanair expects its fuel bill to be €1 billion higher in the current fiscal year, saying that higher revenue will make up for the jump.

“We’ll make enough profit, we believe, based on what we’re seeing to cover our extra fuel bill and then we will grow that modestly,” Chief Financial Officer Neil Sorahan said in an interview.

Ryanair has been among the fastest to recover from the Covid-19 pandemic,and has gained from budget-minded passengers hunting for bargain holidays in the sun. This month, the Irish discount carrier ordered as many as 300 Boeing 737 Max jets as it targets 30% of the European air-travel market by 2034.

Cash Position

The carrier’s outlook for the current financial year displays a sense of confidence, Bernstein analyst Alex Irving said in a note to clients. “With a net cash balance sheet and cash from operations in our view likely to cover capex on an ongoing basis, we expect cash returns to follow next - though no news on that yet,” Irving said.

Ryanair’s cash position stood at €4.7 billion at the end of its fiscal year, and the company said it plans to retain “a broadly flat” net cash-to-debt position.

The CFO said he’s confident the company will hit its goal of transporting 185 million passengers this year, even after Ryanair cautioned in its statement that the number might be slightly lower because of delays at Boeing Co., the sole supplier of its aircraft. The airline ferried 168.6 million passengers in the fiscal year that just ended, a 74% jump.

“As things are trending, we’ll hit the passenger numbers but as always, we’ll be load active, yield passive to achieve that,” Sorahan said.

Ryanair said ticket prices for the summer are trending higher than last year, with fares 10% abov pre-Covid levels. Sorahan said ancillary revenue for services like priority boarding and in-flight food were “very strong”, rising to €23 a passenger from €19 pre-Covid.

Boeing Glitches

Ryanair is Boeing’s biggest buyer in Europe, having built its entire fleet of short-haul aircraft around the workhorse 737 model. Chief Executive Officer Michael O’Leary has been critical of the delays in deliveries of aircraft as Boeing grapples with manufacturing glitches on the jet.

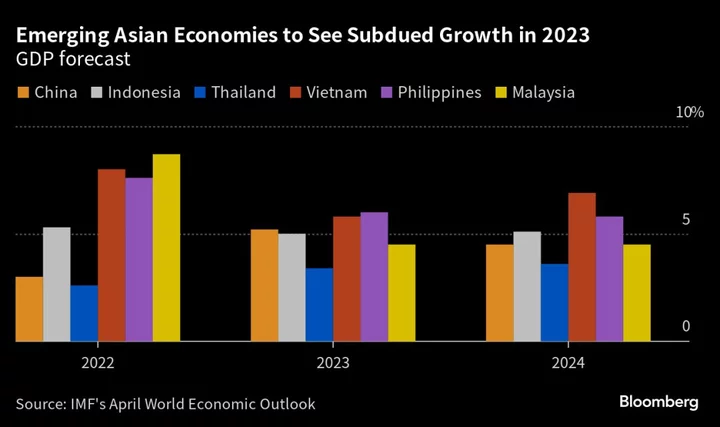

The Covid-era shutdown of some European carriers and scaling back at others has created openings for Ryanair. Sorahan cited growth in domestic flying in Italy — where Alitalia was succeeded by the smaller ITA — in Greece and other sun spots in Europe driving demand this summer.

Longer term, Sorahan expects the carrier to grow in Germany, Morocco and Scandinavia.

(Updates wiht analyst note in fifth paragraph.)