US economic activity probably expanded at a nearly 5% annualized rate over the last three months amid a bevy of temporary tailwinds, according to Bloomberg Economics.

The first official look at gross domestic product for the July-to-September period, due Thursday from the Bureau of Economic Analysis, is set to show strength in consumer spending alongside slower growth in business investment, Bloomberg economist Eliza Winger said Wednesday in a preview of the numbers.

“A frenzy of summer spending on travel and entertainment drove real GDP growth to an unsustainable pace in the third quarter,” Winger said. “The Fed’s tightening cycle is taking time to hit the real economy, but we believe higher mortgage rates, credit-card debts and business-loan defaults will hit growth this quarter.”

Read More: US PREVIEW: Third-Quarter GDP to Blow by Consensus Estimate

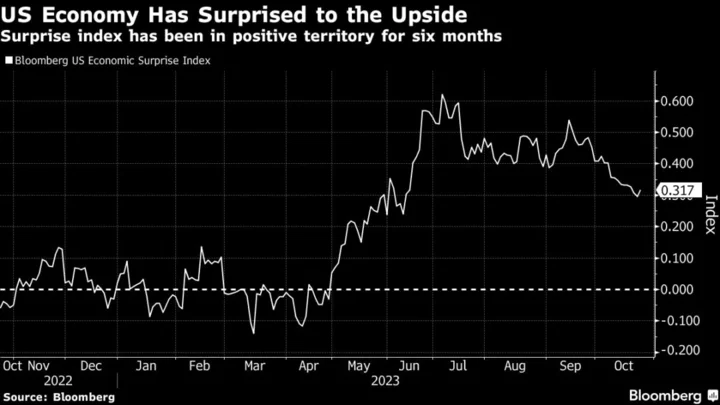

A growth rate near 5% in the third quarter would mark an acceleration over what’s already been a strong year for the US economy, which has expanded by at least 2% in each of the last four quarters. The surprising resilience has kept the Fed on a tightening path despite slowing inflation.

“A large chunk of that strength came from temporary factors — the ‘Barbenheimer’ summer blockbusters, and concert tours by Taylor Swift and Beyonce — as well as factors that don’t necessarily reflect underlying strength, such as a build-up of retail inventories,” Winger said.

“The Fed has raised its benchmark rate by a cumulative 5.25 percentage points to slow the economy, and it’s likely that some of the long and variable lags of monetary policy on the economy have yet to fully play out.”

Bloomberg Economics projects a shallow recession will begin in the fourth quarter. Their 4.9% prediction for the third-quarter report comes in above the 4.5% median estimate in a Bloomberg survey of outside forecasters.